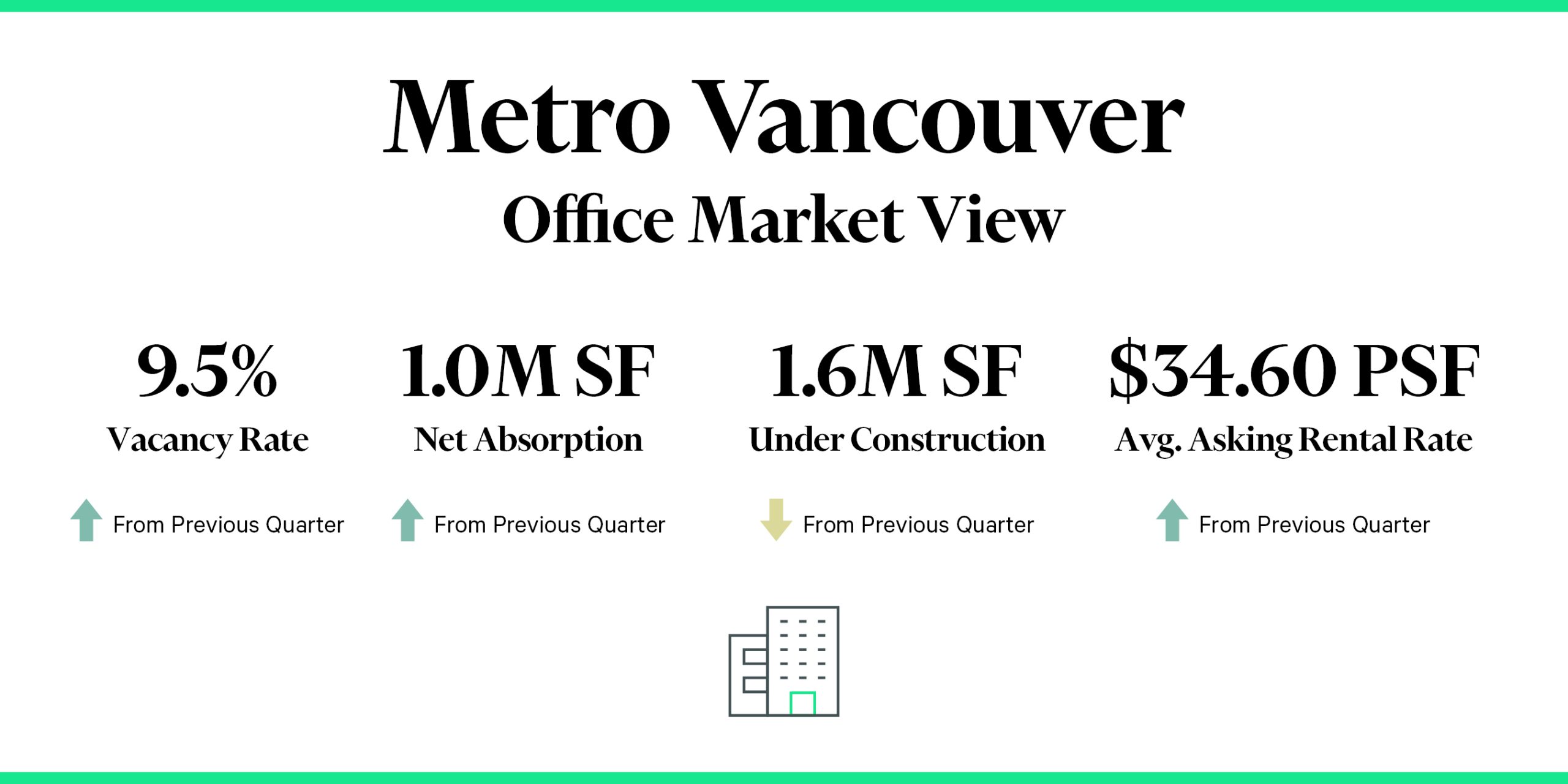

Market Highlights

-

Metro Vancouver faces similar challenges to the national market: bifurcation between quality and commodity space, increasing capital costs for landlords in amenities and improvements, and a paused development cycle.

-

The downtown construction cycle concluded with the recent delivery of 1.2 million sq. ft. 90% of this new supply has been committed to, resulting in a negligible impact to overall vacancy due to high pre-leasing activity.

-

Overall vacancy for Metro Vancouver sits at 9.5%, just 10 basis points (bps) higher than last quarter. Downtown vacancy is expected to drop over the next few years with no new supply on the horizon.

-

The suburban markets are experiencing an influx of sublease supply coupled with the expected delivery of about 1.6 million sq. ft., of which only 35.2% has been pre-leased.

-

A large share of recent leasing activity has included renewals with limited new entrants to the market as tenants are downsizing area but upgrading quality; however, tenant demand remains modest, particularly the traditional Vancouver tenants: business services, FIRE, and technology.